How much does a funeral cost, exactly?

Telegraph Money explains the expenses of saying farewell to a loved one

ByEsther Shaw12 July 2023 • 9:00am

Such is the extent of the cost of living crisis, that the cost of dying is creeping up, too – adding substantial financial pressure for families going through a difficult time.

The average cost of a funeral is currently £4,056, rising to £5,283 in London, according to The Farewell Guide, a site designed to help people through the funeral-planning process.

Figures from SunLife paint a similar picture, with the financial services group putting the cost of a basic funeral only slightly lower at £3,953. However, it warns that when you add in costs such as the “send-off”, (which could include a wake or memorial), and estate administration fees, the true cost of dying rises to a hefty £9,200.

Here, Telegraph Money sets out the costs you’re likely to face when planning a funeral, and whether it can be helpful to set aside money to pay for your funeral while you’re still alive.

Types of funeral

There are three main types of funeral for people to choose from: burial, cremation and direct cremation. Of these, burial is likely to be the most expensive.

According to SunLife, you could expect to pay £4,794 for a burial and £3,673 for a cremation – dropping to £1,511 for a direct cremation.

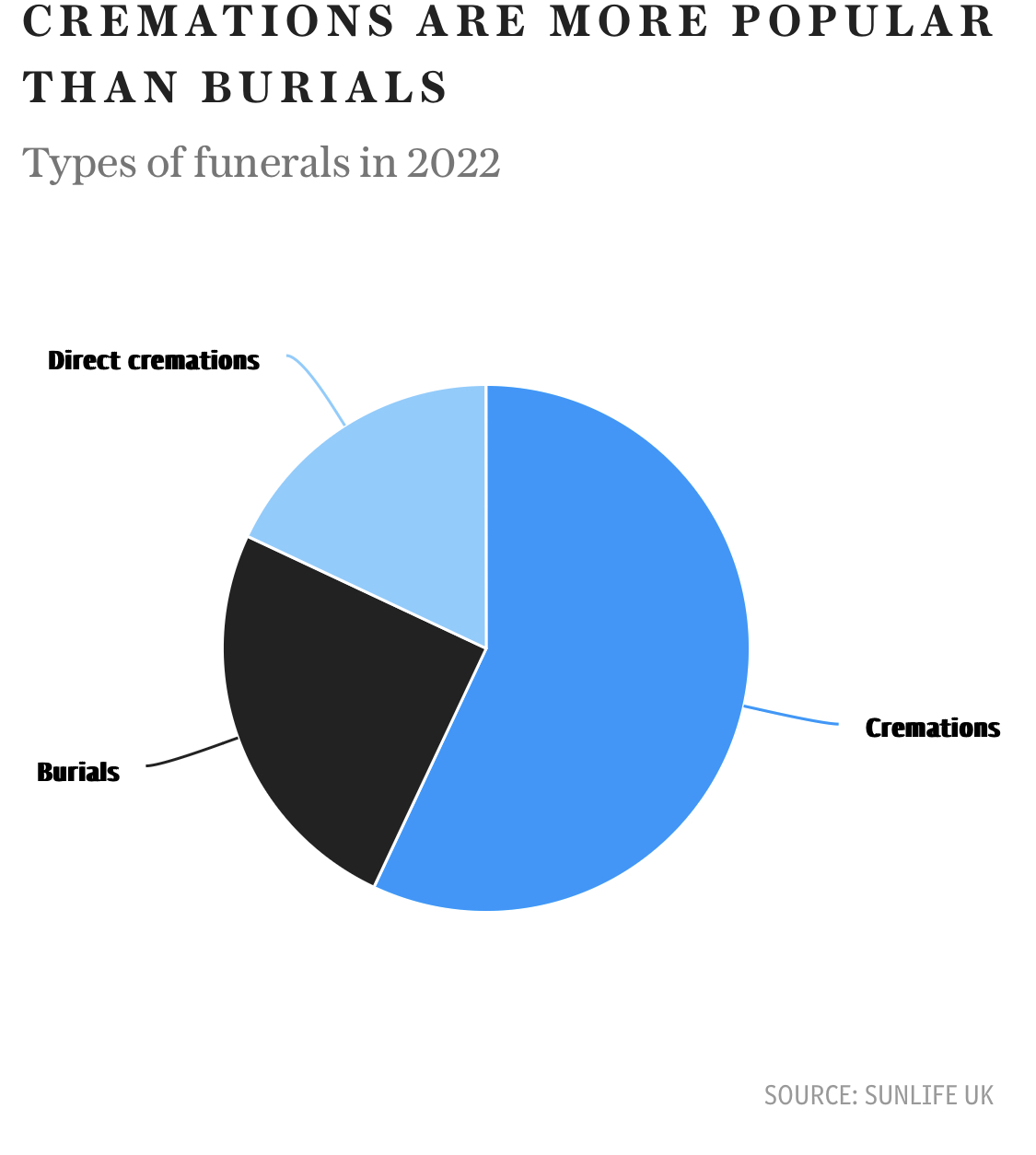

As the traditional funeral format becomes less popular, more people are being drawn to the notion of giving a loved one a “fuss-free farewell” on a budget, with direct cremations now making up almost a fifth (18pc) of all services.

Cremations are more popular than burials

Pie chart with 3 slices.

Types of funerals in 2022

View as data table, Cremations are more popular than burials

Direct cremation

If you’re looking to do things as cheaply as possible, direct cremation is the lowest-cost option.

According to Pure Cremation, a provider of direct cremation, you could expect to pay £1,295 for a hospital death and £1,545 for a home death.

Advertisement

But while the bill is a lot smaller, you also miss out on some of the rituals associated with giving a loved one a send-off.

James Daley from Fairer Finance, said: “With this option, there’s no mourners or service. The deceased is collected and cremated, and the ashes are then returned to the family to be kept or scattered.”

If this sounds a little extreme, you may be pleased to hear there are now versions which are a little less pared back.

Mr Daley added: “With the next-cheapest option a small service is included, and you can have a small number of mourners, though this is typically no more than 10.”

Direct cremations have been boosted by new rules from the Competition and Markets Authority (CMA), requiring that all funeral directors must display a breakdown of their prices online and in their premises – making it easier for people to pick this cheaper option.

There is, of course, the option to go for the basic direct cremation, but set up an event separately, away from the crematorium.

Catherine Powell, co-founder and director of Pure Cremation, said: “More people are choosing celebratory, family-run events in more relaxed surroundings, with a separate unattended cremation.”

Other providers in this sector include Aura Funerals and Distinct Cremations.

Standard cremation

If you’re looking for a funeral with a greater number of guests, a full service, wake and so on, the cost can rise quite quickly.

A standard cremation is a cheaper option than a burial, but still involves a full send-off.

Mr Daley said: “The largest cost you’ll pay is usually the funeral director’s fees, typically around £1,500 to £2,500.

“These will cover collection and storage of the deceased, as well as transportation to the crematorium, and support with the necessary paperwork and organisation.”

You will normally be offered a range of coffins which can vary significantly in price, often upwards of £300. To keep costs down, you could opt for cardboard, as opposed to solid wood.

According to Fairer Finance, you could also expect to pay £164 in doctor’s fees, around £200-£300 for the cost of a minister or celebrant to conduct the ceremony, and between £400 to £1,100 for use of the crematorium.

Bear in mind that these costs can vary a lot, depending on where you live.

Burial

Burials tend to include many of the costs you’d pay for a standard cremation, but you’ll also need to factor in the cost of a burial plot.

Once again, costs can vary enormously depending on where you want to be buried. While £3,000 may be quite common for a burial plot, The Farewell Guide warns that some areas of London charge more than £15,000.

Mr Daley said: “Then there’s the cost of having a grave dug, typically £500 to £1,000, while a headstone can easily set you back around £1,000, and often much more.”

Now read: Water cremation is the latest funeral trend – but how much does it cost?

Other funeral costs

The prices outlined so far are just for the basic services – there are plenty of extras most grieving families want to add as part of their loved one’s send off.

This includes things such as flowers, order of service cards, hearse or horse-drawn carriage, music, the wake, catering, limousines for the family, embalming and more.

While these are, of course, all optional, they can soon add up.

Rebecca Peach, founder of The Farewell Guide, said: “Planning a funeral can be daunting, with few people knowing where to begin. It can be a particularly complex task trying to organise so many different aspects – and get the best price for each of them.”

Now read: Seven things you must do urgently after a parent passes away

How long does it take to plan a funeral?

As a guide, it can take around three weeks to plan a funeral, depending on the availability of the funeral director, as well as demand within the church or crematorium.

To ensure you’re getting a good deal it can make sense to invest time in shopping around to understand the costs charged by different operators in your area.

Whatever you do, don’t just go to one around the corner.

Mr Daley said: “Most funeral directors offer different tiers of packages. The cheapest can often be almost as good as more expensive options.

“The quality of the coffin may be lower, and you may not have as much choice over the time of the ceremony, but all the essentials are usually covered.”

Don’t fall into the trap of thinking the best way to respect the deceased is to spend lots of money – it’s not necessary, and unlikely to be what they would have wanted.

A comparison service can be a helpful port of call, for example with The Farewell Guide (www.thefarewellguide.co.uk), you can compare multiple quotes for free.

While it’s a difficult topic to talk about, it can really help to have had a conversation with your loved ones beforehand, letting them know your wishes.

When the time comes, this can massively reduce the amount of time they have to spend thinking about organising the funeral, as they’ll already know what you want.

Ms Peach said: “By discussing this topic and making at least some basic plans or choices, you can make the process much easier and avoid any potential arguments.

“And letting loved ones know where to find key documents, such as a passport or birth certificate in the event of your death can also really help.”

Now read: Fights over inheritance are rife – here’s how to bulletproof your will

Can I pay for my own funeral ahead of time?

You can pay for your own funeral during your lifetime by signing up to a funeral plan.

The idea is that you slot money away for some of the costs – such as the funeral director, transport and coffin – all in advance at today’s prices. Funeral plans won’t cover everything, though – costs such as burial plots, headstones or wakes are not included.

One of these plans can potentially be a helpful way to remove the hassle for your family and ease stress finding the money to pay for the funeral.

But you need to tread carefully.

Up until 2022, prepaid funeral plans were not regulated by the Financial Conduct Authority (FCA), and there had been instances of unscrupulous firms not selling plans fairly, and not providing value for money. Others lost out when providers went bust.

The FCA is now regulating this sector, with the aim of “enhancing” consumer protection.

Providers had until the end of July last year to submit an application to the FCA.

Two providers, Safe Hands Limited and Ready4Retirement, went bust prior to that.

Safe Hands, which went into administration in March last year, had around 46,000 customers.

These individuals are now waiting to find out if they are going to get any money back, though there are fears this is likely to be just a few pence of every pound they paid into the plan.

The recent demise of Safe Hand should serve as a warning to anyone contemplating paying into one of these plans.

Ms Peach said: “Always take care to do your research and make sure you are getting a good deal from an FCA-regulated provider.”

Read the full article here as featured in the Telegraph.